Boom! Pancentric secures ISO certification for the 6th year in a row

Pancentric's commitment to the ISO 27001 standard has been constant for over half a decade now. And quite rightly with cyber threats on the rise.

Simon Fenn interviews Lares CEO Mike Fenton about starting up a digital-first MGA in his late 50s. Go-Insur CTO Steve Newton provides insights on the tech.

Above - left to right: Simon Fenn, Director Pancentric, Steve Newton, CTO Go-Insur, Mike Fenton, Director Lares

For Mike Fenton, starting up an MGA in his late 50s was about completing unfinished business.

Mike has achieved great things in his 35 year career in personal lines but the goal to launch his own MGA - with partners - remained.

Mike was previously Managing Director of Folgate Underwriting Agency and then Managing Director of Personal Motor at Towergate for 14 years. At Towergate he grew the motor book from zero to £30m+ before leaving to launch Tansar Holdings in 2016.

The Diary of a CEO interview is part of the MGAA's Market Briefing series and looks back on Mike's first 3 years of business - his decisions about proposition, the set-up steps, his approach to distribution and the opportunities offered by different channels.

The full interview with Mike Fenton and Go-Insur CTO Steve Newton can be seen on the MGAA (Managing General Agents Association) YouTube channel from May 2024.

The interview was first live streamed on 18 April 2024.

Lares specialises in non-standard household products (unoccupied, holiday homes etc.).

In the interview, Simon's probed around Mike's reasons for choosing household.

The conversation moved on to distribution.

From a volume perspective the broker software houses were a must-do for Lares. But getting products on to the software house platforms is a significant undertaking.

Simon turns to insurance tech expert Steve Newton, CTO at Go-Insur (the PAS used by Lares), who draws back the curtain on this complex area.

Interestingly, according to a poll run during the Briefing webinar, only 20% of those attending (and over 160 registered) had direct experience of implementing a product with one of the broker software houses.

Simon's questions with Steve focused on these areas;

Simon brings Mike back in to the conversation.

Distributing directly to brokers is particularly pertinent in the specialty MGA space. Simon asks Mike about the opportunities here;

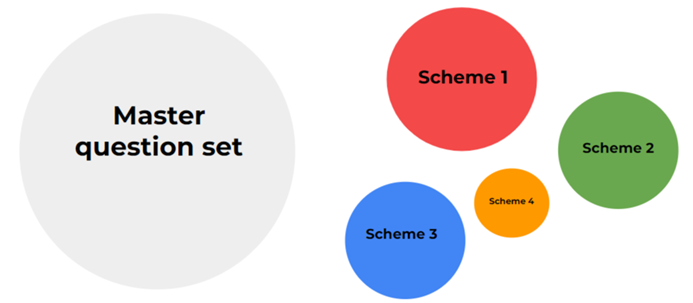

Steve also gives guidance on setting up a policy admin solution alongside the set-ups with the broker software houses.

Steve goes on to describe how a flexible policy admin platform can allow you to 'scheme off' products quickly and easily with minimum cost.

Simon asks Mike about his approach and criteria for selecting a technology partner.

Simon asks Mike about his approach to broker on-boarding.

In the few minutes left, Simon asks Mike about the distribution landsape in 5 years.

The full interview with Mike Fenton and Go-Insur CTO Steve Newton is part of the MGAA's Market Briefing series and can be seen on the MGAA (Managing General Agents Association) YouTube channel from May 2024.

---------------------------------------------------------------------------------

Mike Fenton, CEO, Lares

Mike set up specialty MGA Lares in the midst of COVID. Lares specialises in non-standard household products e.g. unoccupied, holiday homes. Mike’s new MGA venture is built on 35 + years experience in personal lines insurance. Mike was previously MD of Folgate Underwriting Agency and MD of Personal Motor at Towergate for 14 years growing the book from zero to over £30m before leaving to launch Tansar Holdings in 2016.

Simon Fenn, Director, Pancentric and Go-Insur

Simon has extensive commercial, marketing and design experience across multiple sectors including insurance, pharma, telecoms, motor, and broadcast. Simon co-founded Pancentric Digital in 2003 and leads their digital consulting team alongside the commercial development of their SaaS portfolio which includes award-winning policy admin platform Go-Insur.

Steve Newton, CTO, Go-Insur

Steve has extensive experience running IT and business analysis functions and has worked in leading insurers and brands including Ardonagh, Fusion Insurance, Towergate, Insurance4CarHire, NFU Mutual. Steve switched to the tech vendor side in 2014 and now leads development strategy at the award-winning Go-Insur platform.

Pancentric's commitment to the ISO 27001 standard has been constant for over half a decade now. And quite rightly with cyber threats on the rise.

One of the largest independent Driving Instructor motor insurance brokers in the UK Policywave has partnered with PAS Go-Insur from Pancentric to digitise their business.

A new report by our HUB intranet team reveals how businesses are responding to the challenges of remote working