Pancentric orchestrates modernised new look for Insurtech UK

New brand and website launched for trade association Insurtech UK, developed by Pancentric Digital and design partner Kohde

The insurance industry is worth a lot of money. A proper lot of money. A stunningly large amount of money. Really big in fact.

Well, in 2014 the US market alone was worth $1.1 trillion in premium, split roughly down the middle between Life and Health on one side and Property and Casualty on the other. It is also very profitable, with consistent levels of profit over time, which means companies like AIG are able to return $25bn to investors.

Digging a little deeper into the dynamics and characteristics of the industry, there is little or no physical delivery so it’s not dependent on manufacturing or raw materials. It is a mature industry with a relatively small number of very large players, who have the benefit of huge asset bases and access to capital as well as clear distribution chains.

On top of all that (and like many established, sizeable industries), the incumbents have a track record of influencing politicians to put in place legal impediments to deter new entrants with regulations and accreditations.

Which, in 2016, all adds up to one thing – Insurance in the sights of Silicon Valley, venture capitalists and anyone else mixed into the current plat du jour, disruption (see Marc Andreeesen’s ‘software is eating the world’ for more context on this).

Now, before you switch off in anticipation of a prompt to download a 600-page ‘#insurtech 2016: a changing landscape’ whitepaper, fear not. We are not Capgemini, Accenture or KPMG. However, we are an agency with a number of insurance clients and a toolkit for innovation, that makes these changing dynamics worth exploring.

So far, we have seen some innovation in the insurance space but only nibbling around the edges.

P2P insurance, a la Hey Guevara and Friendsurance, has clear proposition benefits because of peer pressure and the potential behavioural change. However, it still needs underwriting to handle scale losses.

Finding niches, as in the Bought by Many proposition, where special interest groups can band together to negotiate is again a good proposition but also limited. Then there are the associated businesses, such as Brolly, which are adding value around the edges in handling your data and so forth.

However, none of these address the big question of how will insurance be disrupted. The existential threats, which haven't arisen yet but that I see as the attack vectors, fall into two categories - the insurer threat and the broker threat.

The current asymmetry of data is being destroyed at a rate that I suspect (feel free to correct me if you think I’m wrong) few insurers are taking notice of. I idly wondered how much information Google and Apple could learn about me on a daily basis, and the results shocked even me.

The Internet of Things will also create an avalanche of data, from which a great deal of intelligence can be inferred, by the good guys and the bad. And when this is added to other data then new emergent forms appear.

Whilst the likes of Swiss Re are looking at using IBM's Watson to price risk in the reinsurance market, their data sets are not as rich as the tech companies. These new crowdsourced data sources will rapidly outpace the incumbents’ historical advantage.

Current service models are geared around the existing models of customer segmentation followed by product development for those segments. These are then distributed on a price comparison basis, encouraging a race to the bottom which affects both cover and service.

Increasingly, consumers expect more individualised propositions that match to their needs and provide the flexibility of dialling cover up and down as needs change. In this context, it’s not hard to envisage the use of machine learning to create a “service comparison” proposition that will replace brokers and price comparison sites.

Improving the relationship between the insurer and the insured, by empowering consumers and helping them make smart choices, can also increase customer satisfaction and reduce pay-outs. Vitality’s healthy lifestyle proposition and Aviva’s good driving proposition are the most noteworthy incumbent examples here, and there’s no doubt that understanding what customers really value will help move insurance from a cold, interrupting, grudge purchase to a value-adding, smooth, lifestyle choice.

Building on “service comparison” engines, the next step would be real-time underwriting using software algorithms to price risk effectively, with AIs negotiating with each other to offer the best price/cover ratios.

We are starting to see this path with the likes of Open Underwriter and others able to offer near real-time underwriting. Rapid advances in the AI field make this more and more feasible and could lead to more accurate and efficient pricing, which is transparent and increases value for all.

Of course, the real threat is the one that we don't see coming (the unknown unknown as Donald Rumsfelt might call it). The name that is always banded around – doesn’t that mean they’re known? - in this debate is Google. For the record, I don't think that Google is too interested in the insurance space at the moment but Nick Gerhart has some good observations about how Google approaches these things.

Clay Kristensen would of course recommend looking for a laughably inadequate competitor scratching around at the bottom of the market that will ‘out-innovate’ the industry faster than you think. Think micro-insurer who is building out a niche in a currently un-insured space.

I'd also worry about Amazon Prime. What if everything you bought from Prime had insurance built in?

If it breaks within three years they replace it and maybe push an upgrade (driving sales).Amazon has access to deep pockets, the ability to execute and the supply chain integration to do this.

As mentioned, this blog was never meant to be a direct line of sight into a crystal ball. What I will leave you with is a quick design thinking method we use to get your own innovation going.

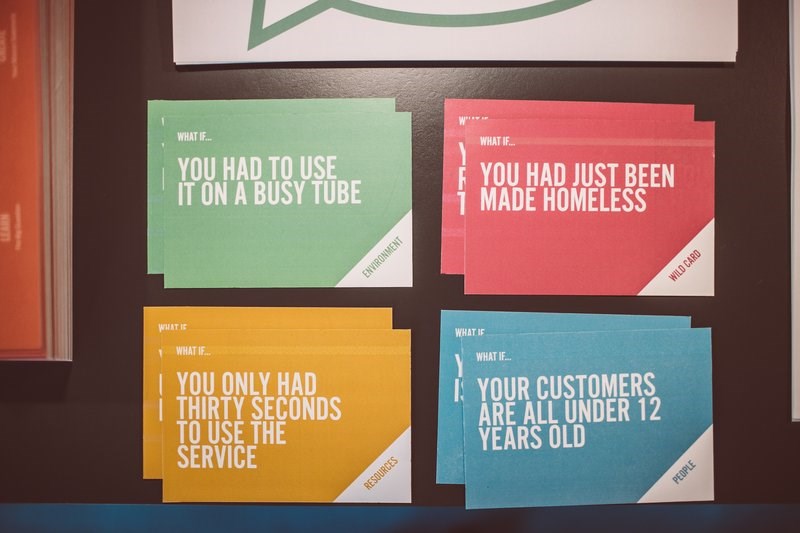

What might happen if you:

We don't know the answers. What we do know is that our unwavering focus is enhancing customers’ lives by first understanding their needs. This involves improving experiences and putting effort and resource into designing service journeys, finding innovative models and always testing, refining and iterating with real people.

New brand and website launched for trade association Insurtech UK, developed by Pancentric Digital and design partner Kohde

HUB Intranet has partnered with QBS, the largest channel-only online marketplace. QBS is the go-to software delivery platform for enterprises, providing a complete solution for long tail software procurement.

Building on recent award success and stand-out work in the specialty insurance space, Pancentric's Go-Insur policy admin solution has launched a brand building campaign in the City of London.