Boom! Pancentric secures ISO certification for the 6th year in a row

Pancentric's commitment to the ISO 27001 standard has been constant for over half a decade now. And quite rightly with cyber threats on the rise.

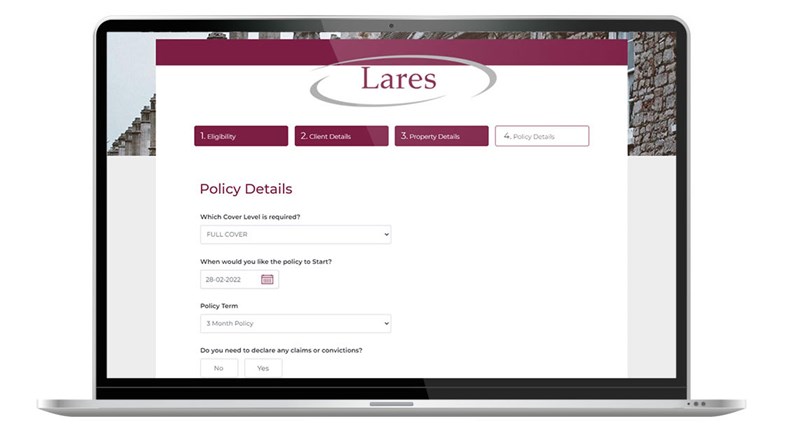

London-based MGA Lares has launched a new household insurance product this month using the Go-Insur platform.

We’re delighted to welcome another MGA client into the Go-Insur fold with specialist MGA Lares choosing Go-Insur to support their plans in the non-standard home insurance space. Lares’s initial Unoccupied product is the first in a series of non-standard household products with more to come over the course of 2022/23.

The engagement with Lares is significant for Go-Insur because it aligns the solution with sector-defining Polaris standards and is the first collaboration with broker platform OpenGI and EDI service provider TrueCommerce. This is a game-changer for Lares and other Go-Insur MGA clients looking for large-scale market distribution and volumes.

Mike Fenton, Director at Lares, says “We needed a versatile insurance platform to maximise our distribution ambitions via established channels like OpenGI and directly with brokers via our own portal. Go-Insur has delivered on both fronts".

"I’ve been impressed with the speed and smoothness of the implementation. From commission to go-live has been 12 weeks. This is good going given the regulatory and technical hoops we’ve had to navigate”.

We needed a versatile insurance platform to maximise our distribution ambitions via established channels like OpenGI and directly with brokers via our own portal. Go-Insur has delivered on both fronts. Mike Fenton, Director, Lares

Brokers can quote & bind either directly on Lares's Go-Insur portal - with a cutdown question set - or for annual and renewing business quote via the full question set on OpenGI. Go-Insur teamed with TrueCommerce to enable the EDI links with OpenGI.

Simon Fenn, Director at Pancentric Digital and owners of the Go-Insur solution, says:

“The alignment with Polaris standards and the collaboration with OpenGI is an exciting moment for our insurance solution. We can now realise significant growth opportunities for Go-Insur clients. It’s exciting to see the first Lares product already transacting via the portal and we look forward to rolling out the rest of their product roadmap during 2022/23”.

Explore Go-Insur's flexible digital insurance platform and request an intro demo to see how it could transform your quote & buy process.

Pancentric's commitment to the ISO 27001 standard has been constant for over half a decade now. And quite rightly with cyber threats on the rise.

One of the largest independent Driving Instructor motor insurance brokers in the UK Policywave has partnered with PAS Go-Insur from Pancentric to digitise their business.

Simon Fenn interviews CEO Mike Fenton about starting up a digital-first MGA at age 60. Go-Insur CTO Steve Newton provides additional insights on the tech.